In the 21st century we are living in a semiconductor world. The global semiconductor shortage that has emerged in recent years poses a serious threat to the mobile electronic market. Manufacturers have been suffering from a growing shortage of chips for more than a year now. Нow it affects the used and refurbished device market, read in today's article.

The semiconductor shortage reasons.

According to the McKinsey report, the global shortage of semiconductors was caused by not one but a number of reasons. The main shortage formula is more demand + less supply.

The demand for smartphones, tablets, laptops and other devices working with the Internet has grown significantly during the pandemic. There is a special chip inside each gadget. With increased demand, there were not enough parts for their assembly since the factories were idle without work. At the moment, the workflow is almost completely restored, however the factories still could not meet the existing semiconductor needs. The situation was worsened by the lockdown logistical problems, which made cargo transportation a weak link in the global distribution of semiconductors.

Another non-obvious problem is water shortage. The technology of growing silicon crystals requires a huge amount of water. TSMC, the global leader in semiconductor manufacturing, consumes an average of about 150,000 tons of clean water per day. And in the past two years, severe droughts have arisen in Taiwan.

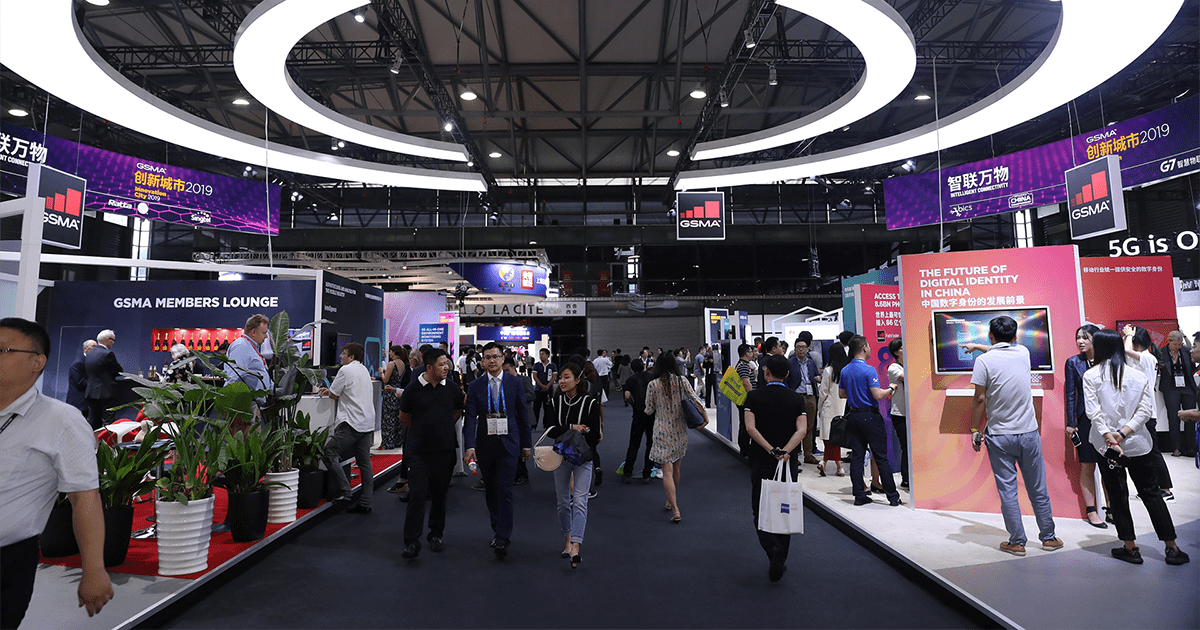

Speaking about the issue, one cannot but recall the political reasons. The trade war unleashed between the United States and China under President Trump has dramatically reduced the competitiveness of Chinese enterprises in the industry, as well as an IT giant HUAWEI. Moreover, having experienced a shortage earlier than others, the Chinese began to massively buy chips from competitors, which stimulated the crisis even more.

Production crisis

Faced with a serious disruption in both supply and demand, chip producers were forced to react with unforeseen speed to effectively restructure their business. Nevertheless, the semiconductor shortage reduced the production of new devices and created a lack of goods for trade. Apple, the world’s largest buyer of chips, delayed the launch of the iPhone 12 by two months; Samsung skipped the release of the new line of Galaxy Note smartphones in 2021.

Automotive and medical diagnostic equipment are among the most affected industries. Oddly enough, mobile gadgets manufacturers turned out to be more protected from “semiconductor storms” than industries that seemed to be less tied to electronics, but they are also going through hard times.

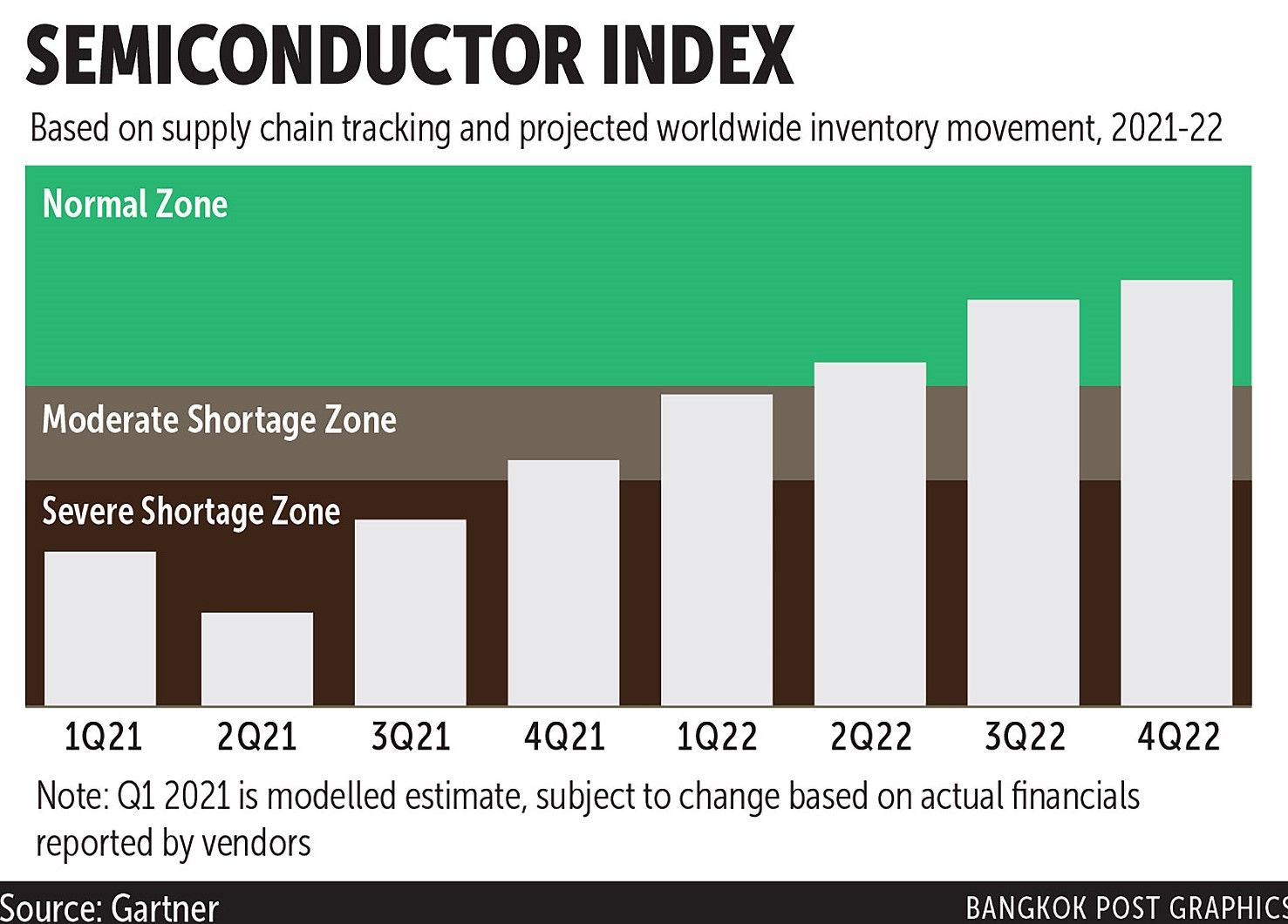

“The problem is even if that 10-cent chip is missing, you can’t sell your $30,000 car,” said Gaurav Gupta, semiconductor analyst at Gartner.

Secondhand market is on the rise.

Manufacturing crisis and rising prices for electronics put the used devices market at the forefront as well as the popularity of trade-in programs increased. People look at refurbished and used devices as a cost-effective way to upgrade their phones while saving money. Such a trend is typical for crisis periods.

According to Hyla Mobile's quarterly report, trade-in programs returned over $757 million to consumers in Q3 2021, a 33% increase as compared to $571 million in Q2 and $569 million in the same quarter last year.

Future forecasts

The situation to be better is not something worth waiting for in this year. This opinion was expressed by Yu Jir Mi, Vice President of Research and Development at TSMC. According to the company's forecasts, the problem will stay throughout 2022.

Intel announced a $100 billion chip manufacturing center in Ohio that is expected to be the world's largest semiconductor facility. The first two factories there are expected to be up and running by 2025. Samsung and TSMC also plan to expand their investments in the US, but their manufacturing facilities will not be launched in North America this year either.

For companies operating in the used electronics sector, this situation means that the market will continue to grow in the near future.