Lately there has been a lot of hype around the 5G topic. Investors are buying up shares of companies that implement the new standard. The companies themselves claim that this technology will turn the whole world upside down. When speaking about networks of past generations, it was a question of global changes for the industry of smartphones, whereas in the context of 5G the IoT sector is usually considered to get the most benefits from the new standard. Is that really so or will the market of used mobile devices experience another global breakthrough with the adoption of 5G?

Let's figure it out.

A few terms at first

The G in this 5G stands for a generation of wireless technology. The main benefits are that 5G networks are intended to support 10–100 times higher mobile broadband speeds and deliver up to 10 times lower latencies than 4G networks do.

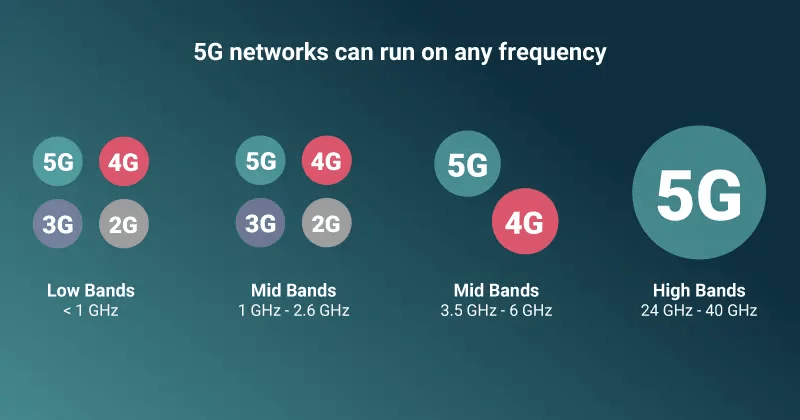

5G networks can run on any frequency, offering three different kinds of 5G experience in low, middle, and high band. All three ranges have their pros and cons:

- Low band (up to 1 GHz): offers the widest coverage but the network speed may only be a small step up from 4G.

- Mid band (1–6 GHz): is considered to provide the best mixture of coverage and speed. The majority of commercial 5G networks run within the 3.3–3.8 GHz range.

- High band (24 GHz and above): high-band or millimetre wave (mmWave) spectrum gives you blazing fast speeds and lots of capacity but suffers from weaker penetration capability, as mmWave signals can travel relatively short distances. Highest speeds can be only reached if you are close to the cell site.

Now you understand the biggest challenge for the future of the 5G technology: to offer customers best performance possible, carriers should have access to large amounts of spectrum. That is why 5G spectrum auctions are conducted and sometimes even whole industries have to be re-equipped to change their working frequencies. Development of harmonised spectrum allocations for sure will lead to a much broader ecosystem in terms of technology, equipment and general engineering expertise. But it is a very complicated, long, and expensive process.

But recent news definitely let us think that the era of 5G is closer than ever now. Google Cloud and Intel have announced their partnership late February. Their cooperation will help communication service providers to accelerate 5G deployment.

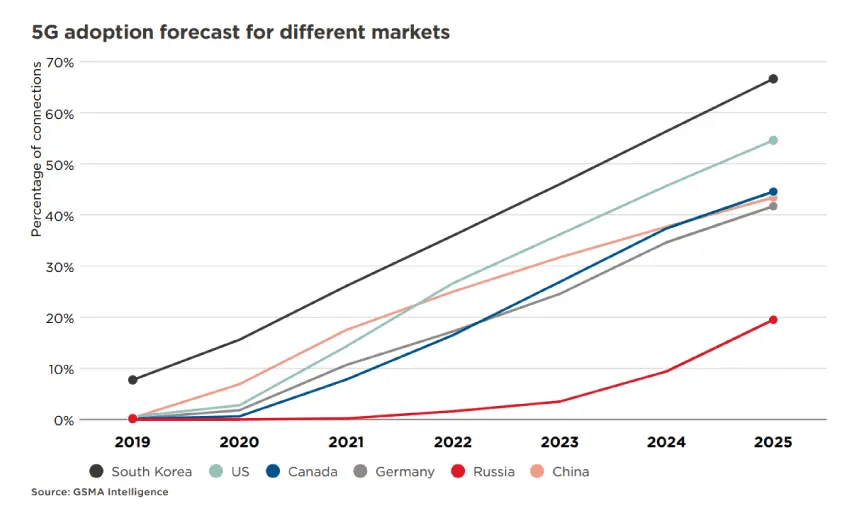

According to GSMA, as of the end of the Q2 2020, 5G was commercially available from 87 operators in 39 markets globally. By 2025, 5G networks are likely to grow their coverage up to one-third of the world’s population. Here is the forecast for different countries:

Old friends and old 4G phones are the best?

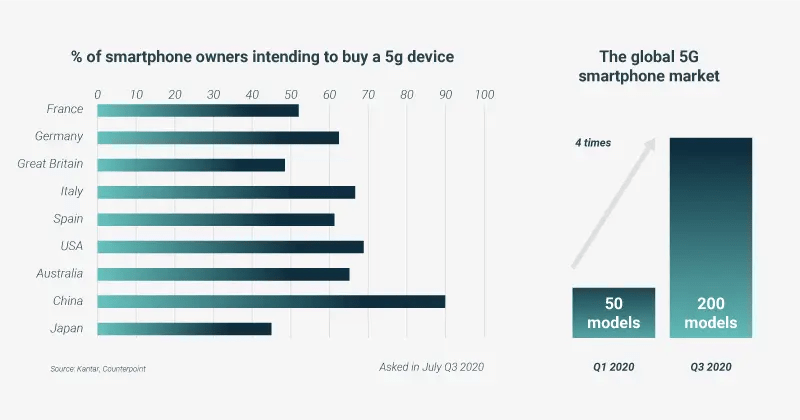

As we have already mentioned in one of our digests, the number of models with 5G support has grown 4 times in Q3 2020 compared to Q1. The top-3 of the most popular models on the market in 2020 spans:

- Samsung Galaxy Note 20 Ultra

- Apple iPhone 12

- Huawei P40 Pro

But do consumers wish to have a 5G device or will these phones collect dust on the store shelves? Kantar claims in its research that in average 45% of their respondents in 2020 are interested in buying a 5G phone within the next 6 months. The leader here is China with 89%, followed by the US consumers with 69%.

Possible profits of 5G for the smartphones aftermarket

It is blindingly obvious that the 5G technology will change the market of used mobile devices. Let us take a closer look at the most probable changes for different branches of the industry.

Retailers and wholesalers can await higher incomes. As demand for 5G gadgets goes up, the impact of Covid is smoothing down, and manufacturers are growing their volumes.

The forecasts for buyback and trade-in businesses are also positive. The standard is quickly gaining in popularity, which means that businesses will have an opportunity to set higher selling prices in comparison to 4G devices.

As for repairers, there are a couple potential points where the 5G upgrade could have an impact. It will let companies provide unique, more expensive services including modifications of 4G devices allowing to use 5G networks.

The key problem for the industry is that the OEM parts market for 5G devices is only in its infancy now. That means that each 5G device should be tested even more thoroughly than a 4G one. In this situation businesses are in dire need of an up-to-date automated solution for mobile diagnostics. NSYS Diagnostics solves this problem easily, providing companies with the newest features needed on the market.

Request a free demo today to stay on the cutting edge of the industry!