We have collected and analyzed some interesting data using the latest Counterpoint Q1 2023 analytics as a forecast basis. So what's going on on the stage right now?

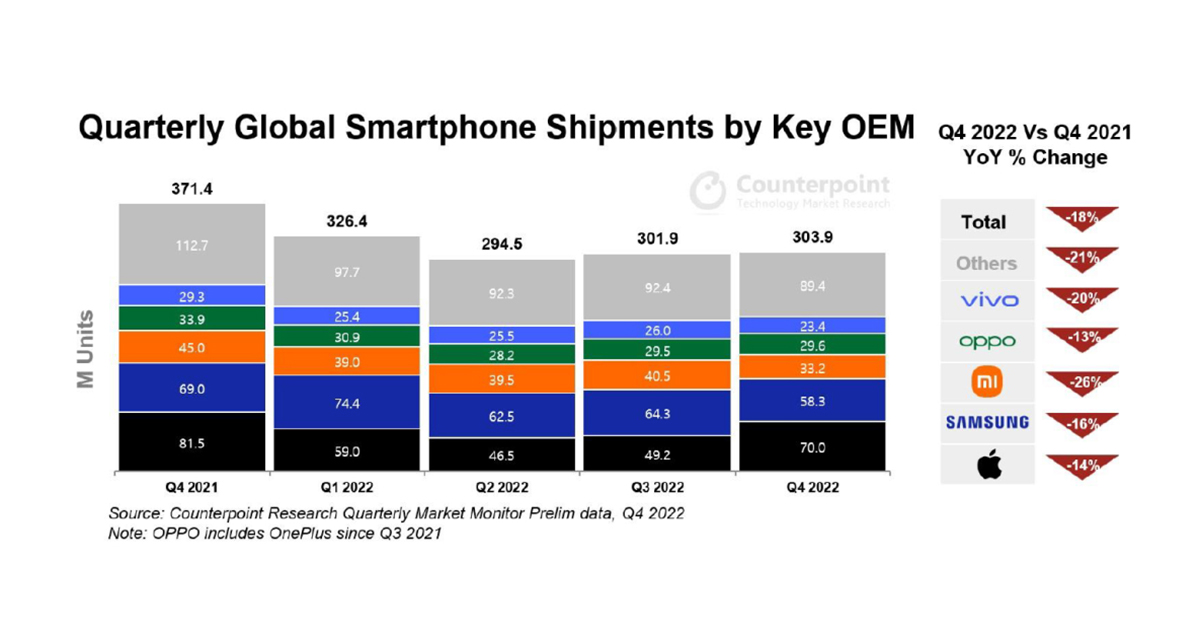

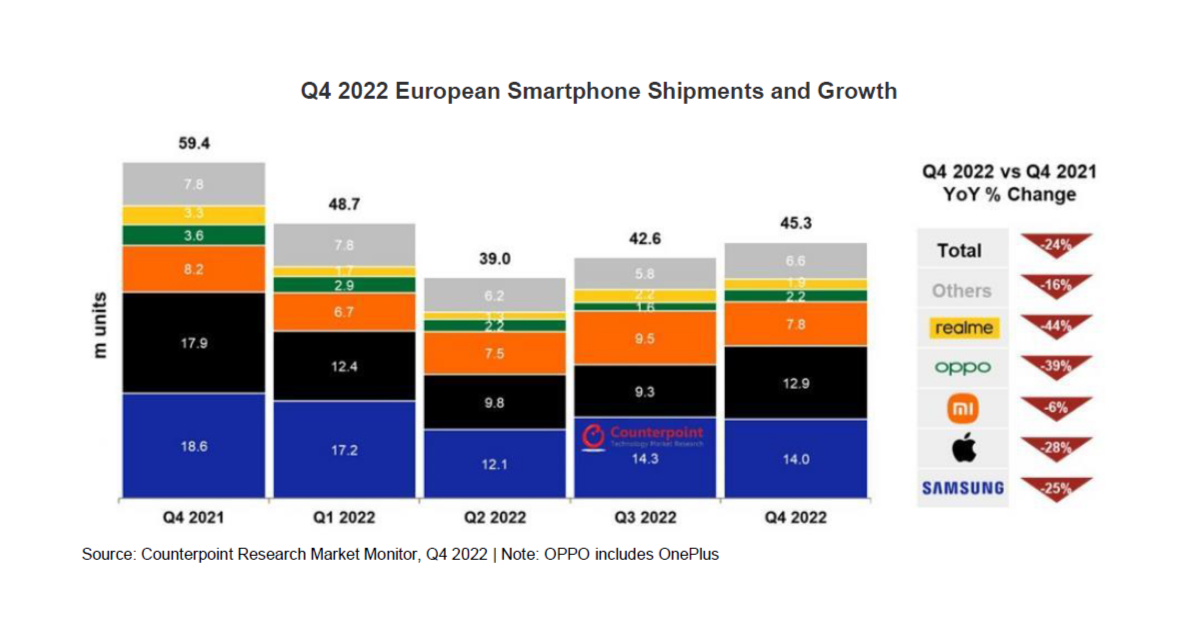

First, let's take a look at the infographic for Q4 2022:

With these numbers, we entered 2023.

High-end Sector Expansion

Statistics show that despite a 12% annual decrease in global smartphone sales, the high-end segment (with wholesale prices of 600 USD or more) has seen substantial expansion. For the first time, it now makes up 55% of the global total revenue.

Affluent customers who remain relatively unaffected by economic challenges are driving this growth, seeking top-quality devices. This "premiumization" trend is present in both developed and emerging regions, as individuals increasingly upgrade to the latest models.

Performance of Apple and Samsung

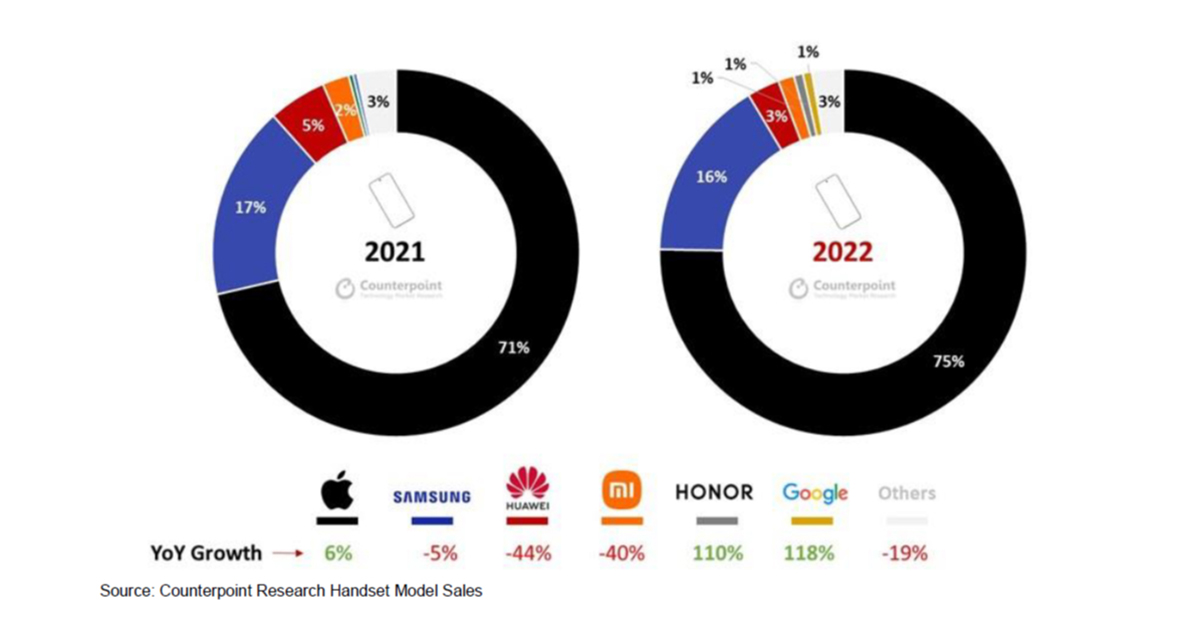

According to the report, Apple experienced a 6% annual growth in premium sales, accounting for 75% of the overall sales. This success can be linked to Huawei's decline in China.

Samsung experienced a YoY decline of 5% in its sales for 2022. The drop was attributed to its limited presence in China, coupled with the delayed launch of the Galaxy S22 series as compared to the S21 in 2021. However, Samsung's foldable smartphones are showing promise, providing a silver lining for the current downturn.

Worst Year for Europe

The EU faced its toughest year in a decade, registering a 24% YoY decline in Q4, with annual shipments plummeting to their lowest point since 2012. Samsung held onto its leadership position even after facing significant shipment decreases, while Apple regained its second-place ranking from Xiaomi. This was achieved despite the launch of the iPhone 14 which happened to be the weakest European Apple performance in a decade.

The volatile economic environment coupled with rising geopolitical tension is expected to persist in 2023. This could strengthen the challenges in the short term. Nevertheless, experts hope that the situation could improve in the latter half of the year, as stabilization of inflation, potential interest rate, and energy bill cuts may help restore consumer confidence and encourage demand, leading to an overall brighter outlook.

5G Implementation in India

India's 5G deployment progressed more rapidly and smoothly than its 4G rollout. As of March 2023, 116,204 5G BTSs had been installed across the country. It is anticipated that 5G smartphone shipments in India will surpass those of 4G devices this year, indicating robust demand for 5G connectivity and associated products.

LATAM region

In Q4 2022, smartphone shipments in Mexico experienced a 21% YoY drop. Samsung maintained its leading position due to its extensive product portfolio and presence in the entry-level price range. At the same time, Apple's iPhone 11 continued to drive volume, resulting in a sustained YoY picture.

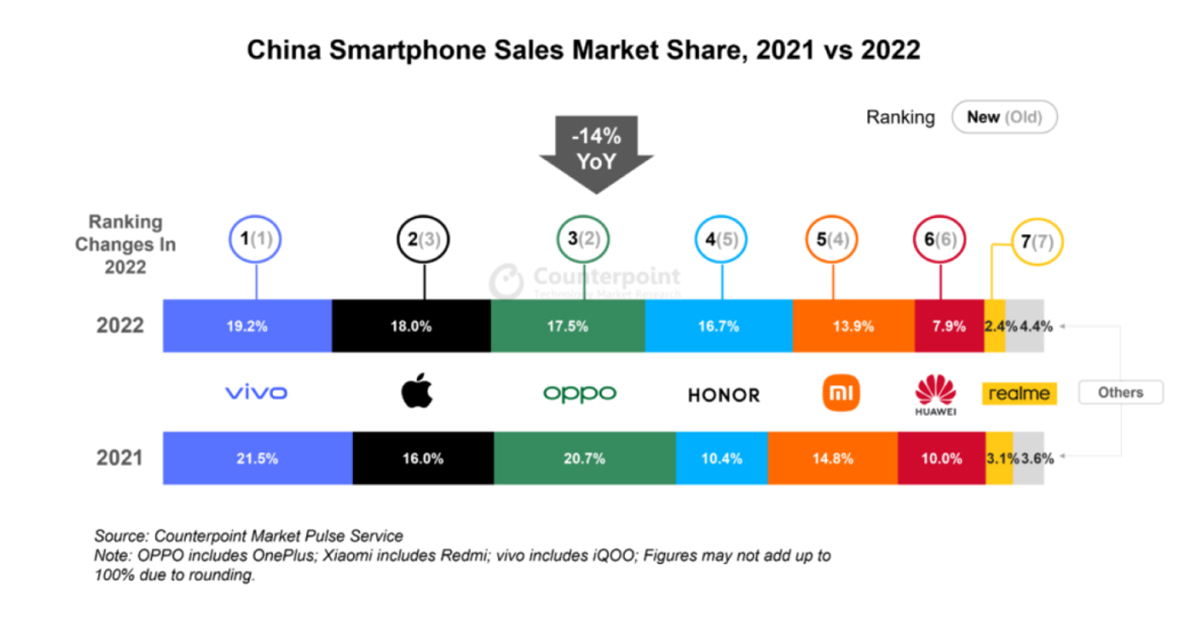

Chinese Smartphone Market Decline and Rebounds

China's smartphone sales reached their lowest point in a decade in 2022, decreasing by 14% YoY. Macroeconomic factors and the ongoing effects of COVID-19 contributed to this decline.

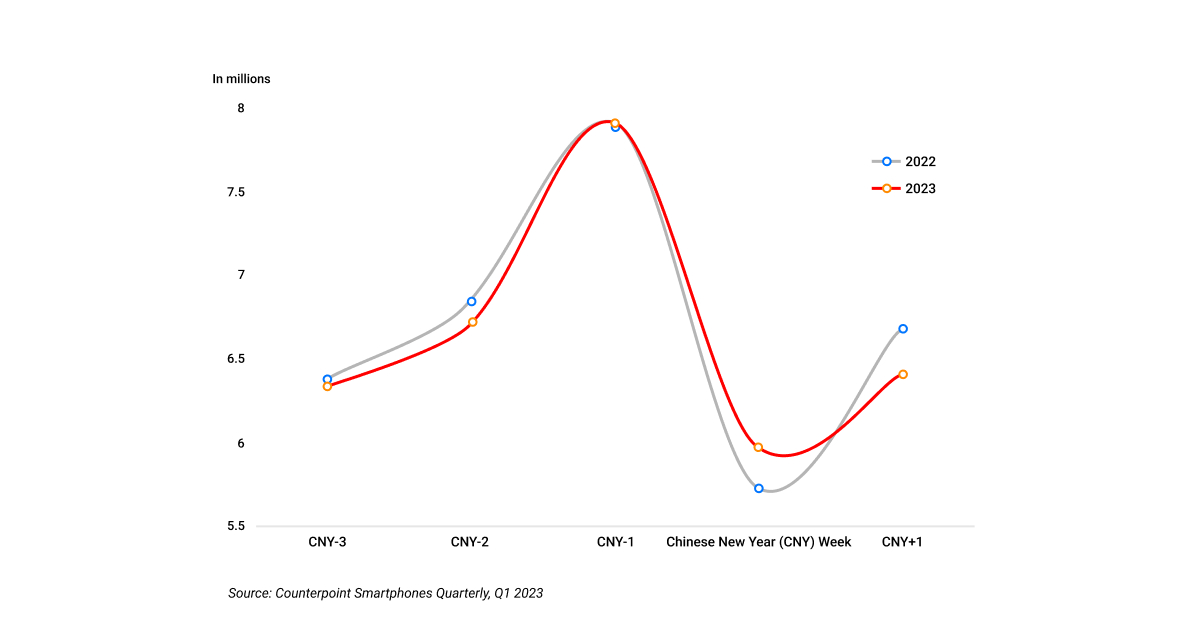

Nevertheless, China experienced a slight YoY growth in January 2023 due to the resumption of everyday social activities and an earlier Chinese New Year season. Weekly sales increased rapidly, with Apple maintaining its position as the largest OEM in terms of sales. The positive trend, along with the "COVID-Zero" policy relaxation, is supposed to provoke a low single-digit growth throughout 2023.

Aftermarket Impact

The shifting dynamics among top players could have several implications for the secondary market:

- Increased demand for secondhand devices. As new smartphone sales decline, consumers may look for more affordable options to upgrade or replace their existing gadgets.

- Greater focus on refurbished devices. Manufacturers like Apple and Samsung may increase their focus on refurbishing and reselling their devices to remain competitive, offering more cost-effective options with the assurance of manufacturer-backed quality and warranty.

- Longer device life cycles. With people potentially opting for used devices, they may keep their smartphones for longer periods, leading to extended mobile life cycles.

- Market fragmentation. As Apple and OPPO experience growth while other top brands face declines, the setting may become more fragmented, with a wider variety of devices and models available.

- Pressure on pricing and margins. The expansion of the pre-owned industry may exert pressure on manufacturers to offer more competitive pricing for new devices, potentially impacting their profit margins.

Stay tuned for more expert analytics and be sure to apply it to your business planning to always make informed decisions!

If you want not only to choose the right strategy but also successfully implement it, pay attention to NSYS tools. With our workflow automation solutions, you can reduce order processing time and cost, increase turnover, improve QC and boost profits.

How? Check out the list of our products and leave a request for a free demo, and our managers will find a perfect solution, especially for your needs!