Automation is no longer a marginal efficiency upgrade in the secondary device market. It is becoming the architectural backbone of how buyback, trade-in, refurbishment, and redistribution will operate in the coming decade. According to CCS Insight, the share of devices processed through automated systems will grow from 31% in 2025 to 45% by 2030, a rise of nearly 50% across five years. For an industry built on high-volume throughput, consistency, and fast resale cycles, this shift is structural, not cosmetic.

Secondary market

NSYS has analysed these trends using both external forecasts and our internal modelling of adoption patterns across the US, Europe, LATAM, and Asia-Pacific. The result is a clear trajectory: automation will become indispensable for operational stability, margin retention, and scalability. Companies that adopt automated workflows in the next two to three years will gain a disproportionate competitive advantage.

Automation as the New Infrastructure

The global secondary market is maturing. Resale channels are now highly professionalised; volumes are rising across all regions; and large carriers set new standards for device grading, diagnostics transparency, and workflow predictability. In this environment, manual processing can no longer reliably scale. Even mid-sized processors hit accuracy and throughput barriers at around 1,000–2,000 devices per month.

Automated workflows eliminate subjective grading, operator inconsistency, and location-based variability. CCS Insight highlights that consistency, not speed, is the primary driver behind automation adoption. Automated systems perform diagnostics, blacklisting checks, cosmetic analysis, and data wiping identically every time, preserving trust through repeatability.

This aligns with the NSYS approach: automation is not a set of machines but an end-to-end quality and reliability framework.

Modelling the Next Five Years: NSYS Forecast

Using the CCS Insight baseline (31% automation in 2025, 45% in 2030), NSYS built a logistic S-curve model to forecast adoption. The emerging picture shows three distinct stages:

2025–2026: Slow acceleration as automation remains concentrated among large US processors and top-tier carriers.

2027–2029: Inflection point driven by lower hardware costs, widespread software-first solutions, and the adoption of modular systems by European and Asia-Pacific refurbishers.

2030: Consolidation at 45% globally, with the US nearing saturation and Europe doubling automated volumes compared with 2025.

NSYS expects the most significant growth between 2027 and 2029, when the economics of automation will cross the tipping point. This forecast is supported by market developments cited by CCS Insight, including the expansion of hardware-agnostic trade-in solutions, the spread of automated kiosks, and the entry of new automated processing providers.

Secondary market

Why the Market Is Shifting Faster Than Expected

Several forces are converging to accelerate automation uptake:

Growing processing complexity.

Devices require deeper diagnostics, more scenario-based functional tests, and reliable data erasure confirmation. Manual workflows cannot meet these expectations at scale.

Demand for grading standardisation.

The industry still lacks unified grading definitions. Automation doesn’t solve the standards gap, but it ensures internal consistency, which is becoming a decisive factor for B2B buyers.

Lower barriers to entry.

Modular automated stations and software-first assessment tools reduce CAPEX and enable smaller refurbishers to implement partial automation.

Shift toward integrated DLM (Device Lifecycle Management).

The industry is moving away from standalone tools toward connected lifecycle ecosystems. Automation becomes exponentially more valuable when integrated into a unified platform.

All of these developments reinforce the long-term need for end-to-end automation, not isolated machines.

The NSYS Advantage: True All-in-One Automation

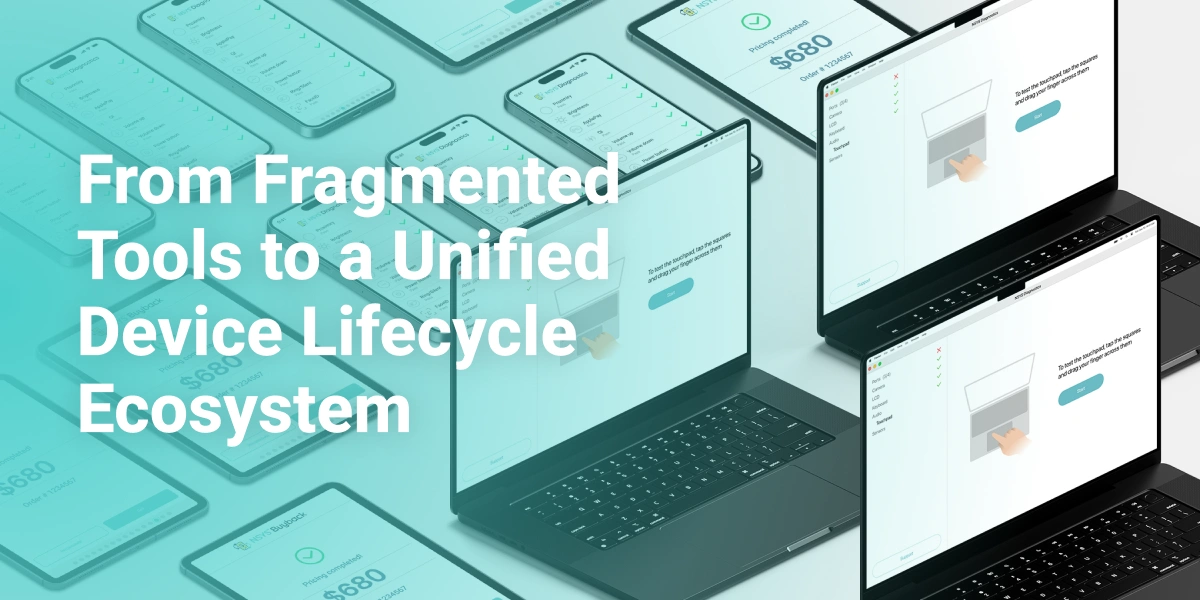

The market’s trajectory validates a direction NSYS defined years ago: automation must be embedded into a unified ecosystem rather than treated as an add-on.

NSYS Ecosystem

NSYS provides a complete Device Lifecycle Management platform that connects every stage of secondary device handling: intake, triage, automated diagnostics, cosmetic assessment, grading, certified data wiping, inventory management, workflow automation, reporting, and analytics. This integration is a competitive differentiator because most industry players operate with fragmented systems.

When automation lives inside a unified ecosystem, processors can scale predictably and maintain consistent quality from the moment a device enters the warehouse to the moment it is shipped.

Reeva: Hardware Automation at Industrial Speed

Automation is not only software-driven. NSYS Reeva, our robotic testing system, dramatically increases throughput by executing operator-level actions at machine precision and speed. Instead of performing point tests manually, Reeva automates:

Functional diagnostics

Touchscreen testing

Button and sensor verification

Automated cable handling

Precise device positioning

Reeva boosts test speed several times over, but the true impact lies in removing human variability entirely. Every device is processed identically, enabling global operations to maintain unified grading standards and predictable SLAs.

Why NSYS Automation Matters More Than Ever

As automation adoption accelerates globally, secondary device processors need more than diagnostic modules or isolated grading tools. They need a stack that ties together:

- automated test execution

- automated grading logic

- data security compliance

- recommerce-ready reporting

- warehouse orchestration

- analytics for forecasting and optimisation

This is where the NSYS platform delivers enterprise-level value: we unify all components into one controllable, scalable, transparent environment.

Regional Differences and How Automation Narrows the Gap

Current disparities across regions are significant. According to CCS Insight:

More than 75% of US device throughput is processed with some automation.

Europe and APAC remain around 15%.

Yet our modelling suggests that Europe and APAC will experience the sharpest growth between 2027 and 2029 due to:

- lower-cost automated systems

- software-first diagnostics adoption

- increased reverse-logistics professionalisation

- growing retailer and operator participation

The adoption curve in these markets is poised to double within five years, positioning them as the fastest-growing automation adopters globally.

Strategic Implications for the Secondary Market

Automation is poised to become the non-negotiable foundation of the industry. In the same way enterprise resource planning systems became essential for retail, automated diagnostics and grading will become the minimum operational requirement for device lifecycle management.

Businesses that adopt automation now will be able to:

- scale volume without increasing labor

- achieve uniform grading across sites

- deliver predictable quality to buyers

- maintain profitability in a margin-compressed market

- respond to fluctuations in global supply and demand faster

For companies planning long-term growth, automation is not merely a future upgrade. It is the infrastructure for the next decade of the secondary device economy.

Conclusion

Automation will reshape the global secondary device industry faster than previously anticipated. With global automated processing projected to reach 45% by 2030, the market is entering a phase where consistency, transparency, and speed are mandatory, not optional. NSYS predicts a steep acceleration of adoption between 2027 and 2029, especially in Europe and APAC, driven by lower-cost modular systems and fully integrated software-first diagnostics.

NSYS is uniquely positioned to lead this shift. With the NSYS ecosystem and automated solutions like Reeva, we provide the technological foundation processors need to scale reliably, unify operations, and stay competitive in a rapidly transforming market.