The smartphone market has seen significant changes in Q2 2023. This article aims to provide an in-depth examination of these trends, offering key insights and predictions for future growth.

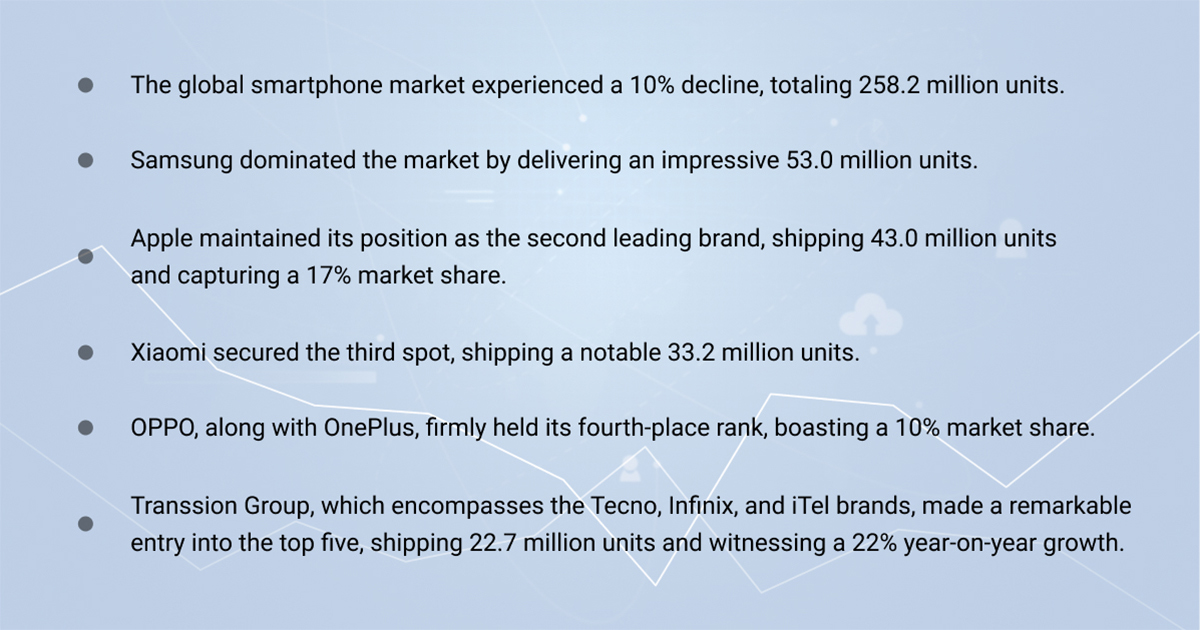

First, let's take a quick look at the important numbers:

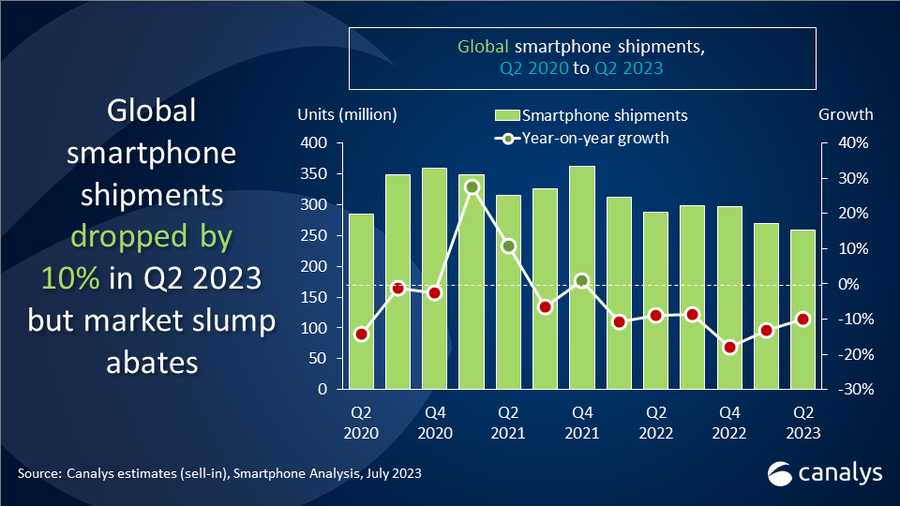

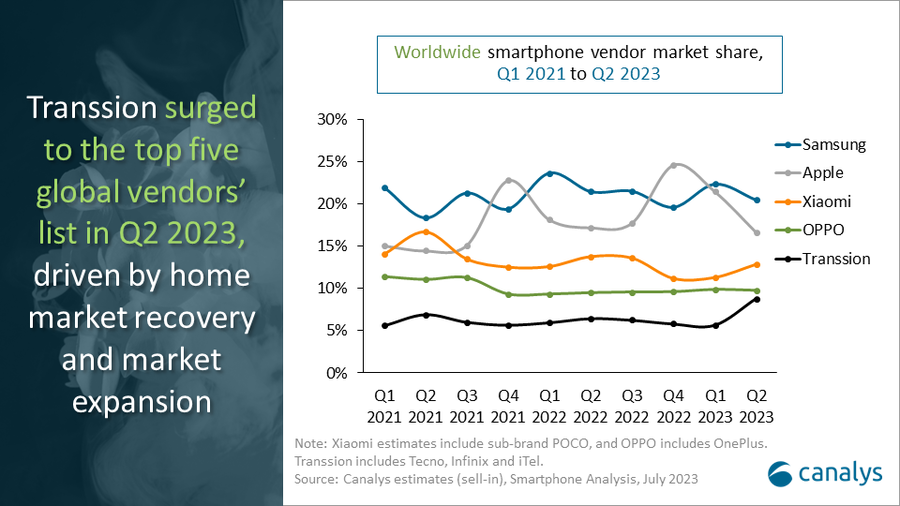

The graph comparing the last few years reflects a detailed shipments situation:

Consumer demand overview

According to Counterpoint Research Q2 2023, US shipments fell 24% year-on-year. Customers' reluctance to make mobile upgrades has been a central brake. This tendency is expected to continue in Q3.

Matthew Orf, Counterpoint Research Analyst:

Despite inflation numbers falling through the quarter and ongoing strength in the job market, consumers hesitated to upgrade their devices amid market uncertainty. We expect this trend to continue through Q3 2023, but the expectations from the upcoming iPhone 15 remain bullish.

Other markets showed mixed trends, with declines in Europe, Vietnam, and China but growth in regions like Ecuador.

Apple’s Dominance Continues

Despite a slight decrease in shipments compared to last year's period, Apple's share still grew by 10% year-on-year. Active promotional activities through various channels contributed to the stable work of Apple.

Apple continues to reap the benefits of growing premiumization. In June, its revenue share hit a Q2 record. The premiumization trend will likely continue despite the average selling price growth stagnating.

Samsung reached its lowest Q2 figures since 2013 due to the low number of new models launched. The company plans not to lose its position in the high-end sector.

Amber Liu, Canalys Analyst:

With the high-profile release of its latest Galaxy Z Flip and Fold models, it has clearly demonstrated its ambition to compete with Apple in the luxury market.

Predictions for the Upcoming Future

Analysts predict a potential shift with the launch of the iPhone 15 and further developments in the foldable segment. Motorola and Google have already introduced new models in the 2nd quarter of 2023. Samsung is expected to launch new Galaxy devices. Interest in foldable smartphones is predicted to continue its growth.

Experts foresee a slight dip for 2023. The latter part of the year is expected to bring a healthier business atmosphere, promoting positive sentiment among industry members. Enterprises adept at managing short-term changes while addressing long-term industry shifts will likely thrive despite the downturn. Economic uncertainty and low upgrade rates may stay challenging, but new launches and innovations may offer opportunities for growth.

Aftermarket Impact

Given the 10% downgrade in shipments, along with the 24% in the US, there could be a surge in demand for used mobiles. Economic instability potentially leads people to consider more affordable pre-owned or refurbished items as a viable option.

Old iPhone models retain their value. With the anticipation of the 15th generation, a more considerable influx of second-hand iPhones may enter the market as users offload their previous gadgets.

Budget-conscious consumers might not be willing or able to spend on high-end handsets. This could drive them towards secondary alternatives, especially for luxury brands like Apple and Samsung.

If you always want to stay updated with unique analytical information, subscribe to our email newsletters and get valuable materials on chosen topics. Expert analyses, the latest news, useful case studies to learn from competitors, and much more are available to you for free!