Mobile retail has undergone significant changes in recent years. One of the most notable shifts has been the migration from traditional high-street retail to online shopping. This transition isn't just a fleeting trend but a reflection of changing consumer behaviors and preferences.

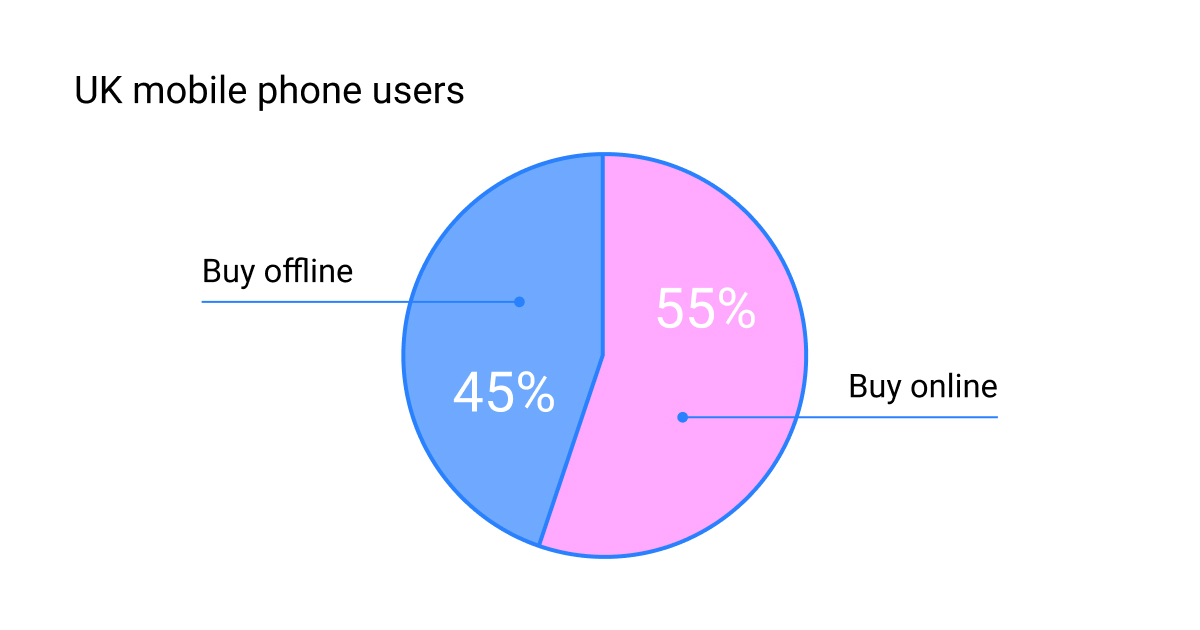

A study by CCS Insight shows that 55% of UK mobile phone users now buy their phones online. More young people, particularly those between 16 and 24, prefer purchasing mobile phones online, with 66% opting for this method.

However, this doesn't imply that physical retail outlets have lost relevance. On the contrary, brick-and-mortar stores are crucial in the mobile retail ecosystem. They're essential for customers, providing hands-on experience with products, in-store deals, and direct help from store staff.

Online vs Offline

The shift towards online purchases in the UK's mobile retail sector indicates a global trend. Many consumers worldwide gravitate towards online shopping because of its convenience and ability to compare prices seamlessly. This trend is particularly evident in the UK, where most people purchase online mobile phones.

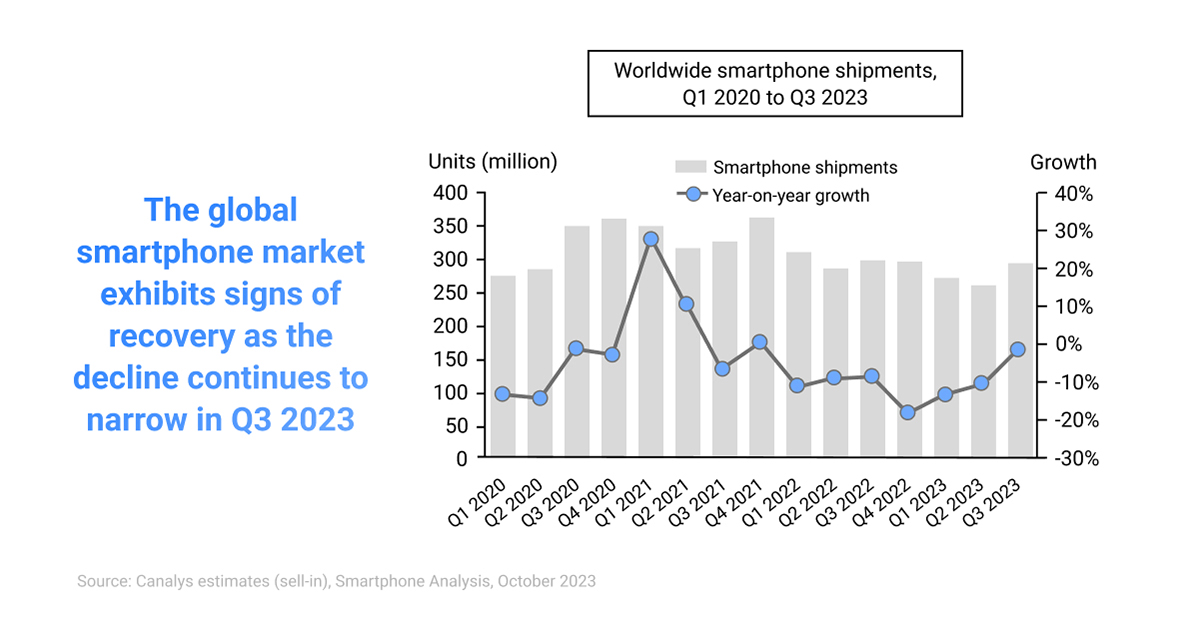

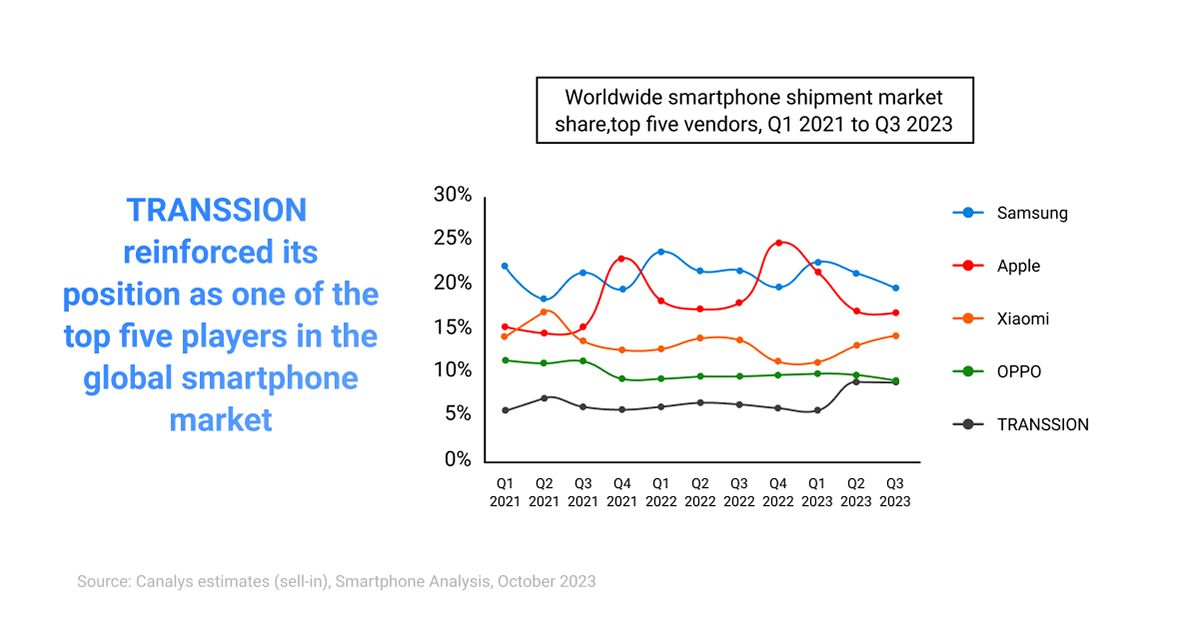

Smartphone market

The global smartphone market had a slight decrease of 1% in Q3 2023, according to Canalys. Despite this dip, industry giants like Samsung, Apple, and Xiaomi have managed to maintain their stronghold. Samsung leads the pack with a 20% market share, closely followed by Apple at 17% and Xiaomi at 14%. Q3 2023 saw a 1% decline, but double-digit solid growth suggests recovery from previous setbacks. New products, such as the iPhone 15 and the new Huawei Mate series, could catalyze sales growth as the season approaches.

Market Dominance

Even with stiff competition from brands like Xiaomi and OPPO, Samsung and Apple continue to dominate the smartphone market. Different smartphone manufacturers employ varied strategies to boost sales. Samsung prioritizes profitability, shifting from the budget market, while Xiaomi and TRANSSION actively expand in developing markets.

Strategic Focus

Major brands such as Samsung and Apple are concentrating their resources on their flagship models. In contrast, brands such as Xiaomi and TRANSSION design their products specifically to meet the needs and preferences of emerging markets.

Experts’ Insights

Marko Melicevic, Business Development Manager at ProMobi

Marko shared his thoughts on the current state of the mobile industry.

Many regions are reaching high smartphone penetration rates, which might leave limited room for significant growth, leading to a decline in sales. Economic downturns or uncertainties can make consumers spend less on non-essential items like smartphones. We should recognize supply chain disruptions, such as component shortages or shipping delays, which can impact production and sales. If major manufacturers released new models in the previous quarter, it could cause a temporary sales dip as consumers await the latest offerings. Online shopping, on the other hand, has seen substantial growth. The convenience it offers, a broad array of options, and safety protocols during the COVID-19 pandemic have further fueled its rise. Traditional brick-and-mortar stores aren't left behind; they're adapting by enhancing their online presence and offering seamless omnichannel experiences. This digital shift also means more consumers use smartphones for online shopping, intertwining mobile commerce even more deeply with consumer behavior. A notable trend in the smartphone industry is its lean towards sustainability and eco-conscious manufacturing. The concern for the environmental impact of electronic waste is increasingly prominent among consumers. In response, manufacturers opt for more eco-friendly materials, reduce packaging waste, and produce energy-efficient devices. The rise in sales of refurbished devices in our market is evident, and the expectation is that this trend will continue to grow.

TekEir's Perspective on the Evolving Smartphone Landscape

Delving further into the dynamics of the global smartphone market, TekEir, the leading seller of consumer electronics in Europe, the United Kingdom, and the United States of America, also weighed in on the observed trends.

Factors Behind the Market's Recent Downturn

The recent contraction in Q3 2023 has roots in several intertwined factors. Market saturation has become more evident, especially in mature markets. The incremental feature enhancements between successive phone models have caused consumers to prolong their upgrade cycles. External challenges like supply chain disruptions and the increased costs stemming from component shortages have also influenced consumer purchasing decisions. Additionally, the timing of significant product launches plays a role, with a possibly quieter Q3 hinting at anticipated major releases in Q4.

Anticipations for Q4

The coming quarter holds a sense of cautious optimism for TekEir. Historically, Q4 has been characterized by a rise in sales, boosted by seasonal shopping sprees and new product introductions. The launches from leading manufacturers might induce a flurry of upgrades, potentially offsetting the previous dip. However, looming economic and logistical challenges could still pose threats.

Digital Transformation in Retail

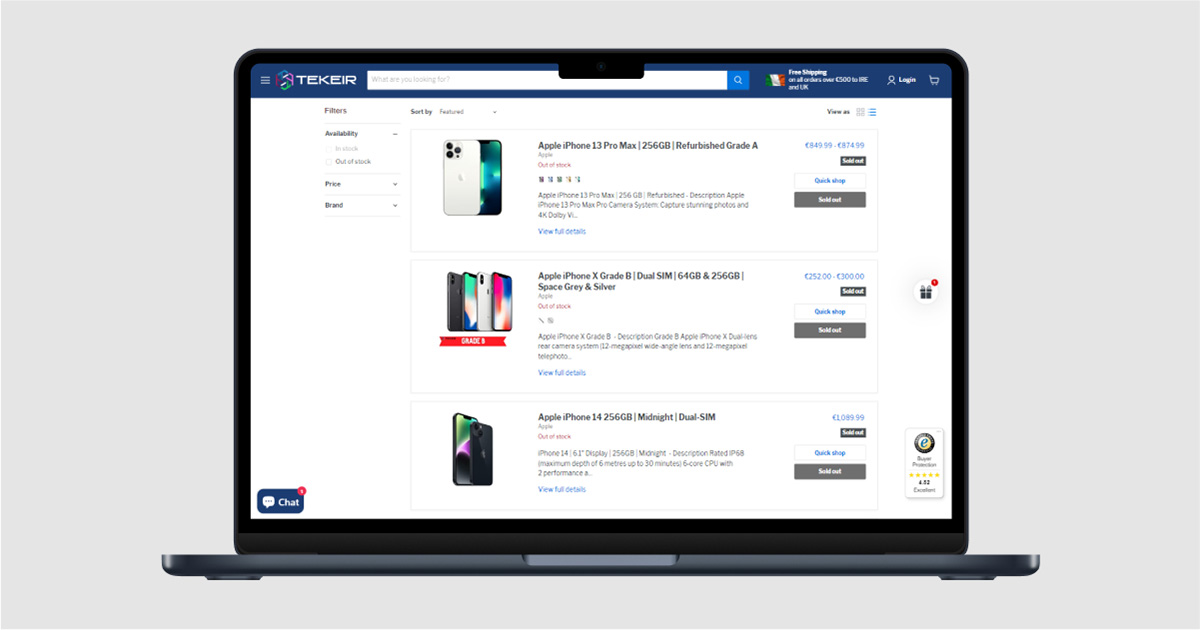

The accelerated shift to online shopping, propelled by the pandemic, shows no signs of waning. TekEir acknowledges the advantages of online platforms, especially for mobile devices, allowing consumers to make well-informed decisions through detailed comparisons and reviews. In response, TekEir has bolstered its e-commerce capabilities, aiming to offer digital experiences that echo the tangible benefits of in-store shopping.

Sustainability Taking Center Stage

The spotlight on sustainable consumerism has become brighter. TekEir, actively involved in the refurbished device market, anticipates growth in this area. With increasing awareness about environmental impacts, refurbished devices are emerging as an attractive option. For businesses like TekEir, championing transparency, especially around refurbishing processes, is crucial to assuring quality. TekEir emphasizes that sustainability is more than a trend – a shared responsibility that echoes benefits across the board.

Practical recommendations

Given the changing market trends, buyback and trade-in programs are becoming popular for businesses. We want to highlight NSYS Buyback, a tool for businesses to improve these programs. NSYS Buyback stands out because it helps businesses understand the actual condition of devices, allowing them to set fair buyback prices. This makes the process more open and profitable and builds trust with customers.

We designed NSYS Buyback for ease and efficiency if we look closely at it. It has tools for automatic device checks, from IMEI verification to assessing a device's appearance and function. This helps businesses set fair buyback prices. Plus, with data security being vital today, NSYS Buyback provides secure data deletion methods, meeting international standards.

Recommendations:

- Strengthen Online Sales: Retailers and brands should amplify their online sales efforts, offering special promotions, discounts, and bonuses to attract customers.

- Innovate: Manufacturers must continue their innovative endeavors, introducing new products to stimulate demand.

- Prepare for the Festive Season: With the upcoming sales season, brands should actively promote their products, offering special promotions and discounts.

The mobile retail landscape is moving, shaped by changing consumer behaviors, technological advancements, and innovative business strategies. NSYS Buyback assists businesses in attracting and retaining customers. It enhances buyback and trade-in programs to promote growth and competitiveness in the business world.

Sources: