The global smartphone market is facing a significant shift in cost dynamics as memory chip prices — especially DRAM and NAND flash — rise sharply. Research firm Counterpoint Research has revised down global smartphone shipment forecasts for 2026, directly linking the change to increased memory costs passed through the supply chain. This marks a clear departure from the growth trajectory the industry had expected earlier this year (telecoms)

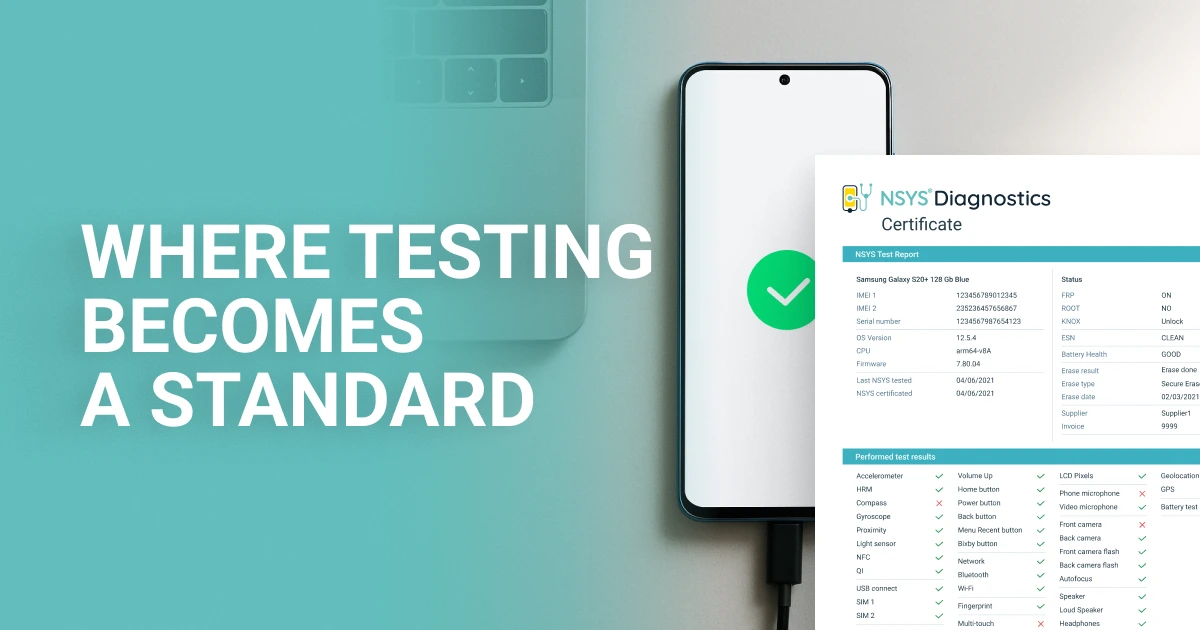

This trend matters not only to manufacturers of new devices, but also to refurbishers, trade-in partners, and secondary market operators. From NSYS’ perspective, rising memory costs act as a multiplier of existing inefficiencies in the used phone market — especially around pricing accuracy, grading consistency, and inventory planning.

Why Memory Prices Are Rising

At the core of the issue is surging demand for memory chips driven by artificial intelligence infrastructure. Data centers powering large language models and machine learning applications consume vast amounts of DRAM and high-performance NAND flash. As semiconductor producers prioritize advanced memory production for AI and enterprise clients, supply for mobile-grade memory becomes tighter and contract prices increase.

Industry reporting confirms that memory prices climbed sharply throughout 2025 and are expected to remain elevated into 2026 (ferra)

From an operational standpoint, this is not a short-term fluctuation. For the secondary market, it represents a structural shift in how device value is formed and preserved over time.

How This Affects New Smartphone Prices

Counterpoint Research outlines several direct consequences for the primary market:

- Global smartphone shipments are projected to shrink by about 2.1% in 2026, reversing earlier growth expectations (mactech)

- Average selling prices are expected to rise by roughly 6.9% year-on-year, as manufacturers pass higher component costs to the market (telecoms)

- Budget devices are hit hardest, with bill-of-materials costs rising by 20–30%, while mid-range and premium segments see more moderate increases (mymobileindia)

To protect margins, OEMs increasingly reduce specifications in entry-level models — including memory configurations themselves (mobileworldlive)

An additional consequence of rising memory costs is that many upcoming smartphones are projected to have smaller RAM and storage configurations compared to previous generations, effectively making devices “simpler” or less capable despite higher prices. According to CNews, models with 16 GB RAM are expected to nearly disappear in 2026, while even budget devices with 4 GB will cost significantly more (CNews)

This trend highlights a growing performance gap between high-spec refurbished devices and constrained new models, which further strengthens the value proposition of the secondary market.

Implications for the Used Phone Market

Based on NSYS’ experience working with refurbishers, marketplaces, and B2B resellers, rising memory prices in the new device segment translate into four practical effects on the secondary market.

1. Higher Demand, But More Selective Buyers

As new smartphones become more expensive or less attractive in base configurations, many consumers delay upgrades or actively seek refurbished alternatives. This increases demand for used devices — but not indiscriminately.

Buyers become more selective, focusing on:

- usable memory capacity,

- long-term performance,

- value compared to downgraded new models.

This favors well-documented, correctly graded devices over generic “same-model” listings.

2. Memory Configuration Becomes a Core Pricing Variable

Memory has always influenced resale value, but rising prices amplify this effect. In practice, NSYS observes that:

- Devices with higher RAM or storage retain liquidity longer

- Price gaps between memory tiers widen faster than before

- Treating all units of the same model equally leads to systematic mispricing

As a result, configuration-level diagnostics and pricing are no longer optional — they are essential to margin protection.

3. Greater Volatility in Residual Value

As OEMs adjust specifications from generation to generation, residual value curves become less predictable. Lower-spec devices depreciate faster, while better-configured units behave more like mid-tier assets.

For secondary market operators, this increases:

- inventory aging risk,

- pricing errors,

- dependence on outdated historical averages.

From NSYS’ perspective, this is where data-driven grading and analytics replace intuition as the primary decision tool.

4. Longer Lifecycles, Higher Quality Supply

A positive side effect is that consumers keep devices longer, which eventually feeds the secondary market with better-maintained units. This supports both sustainability goals and higher average quality of refurbished stock.

However, longer lifecycles also mean that accurate condition and performance assessment becomes even more important at intake.

Strategic Actions for Used Phone Businesses — The NSYS View

To adapt to a memory-driven market shift, NSYS recommends focusing on three areas where operational discipline delivers measurable results.

Precision Configuration Detection

Reliable identification of RAM and storage at intake ensures fair pricing and prevents hidden margin loss caused by under- or over-valuation.

Dynamic, Data-Backed Pricing

Static price bands no longer reflect market reality. Operators need pricing models that account for:

- configuration differences,

- changing demand patterns,

- evolving new-device specs.

Transparent Value Communication

As the gap between new and used devices narrows in real-world performance, clearly communicating verified specs and performance metrics becomes a key conversion driver.

Conclusion: A Structural Shift, Not a Temporary Shock

The surge in memory costs — confirmed by Counterpoint Research and multiple industry sources — is changing how value is created and preserved across the smartphone lifecycle.

For the used phone market, this is not just a demand boost. It is a redefinition of value, where memory configuration, verified performance, and data accuracy play a central role.

From NSYS’ standpoint, companies that rely on simplified grading and static pricing will face growing margin pressure. Those that invest in diagnostics, analytics, and standardized processes will be able to turn memory-driven cost inflation into a long-term competitive advantage.